Individual administration of funds isn’t simple all of the time. Truth be told, many individuals are struggling with assuming responsibility over cash matters and some even wind up spending more than whatever they procure notwithstanding having a financial arrangement. How might you deal with your funds all the more really? The right systems are fundamental to make things work. Consider the accompanying money tips from the specialists:

Put forth a positive objective. What might you want to accomplish inside the following 3 or a half year or year? Putting an unmistakable objective is significant together to make a reasonable arrangement. For instance, on the off chance that you as of now have neglected obligations with various lenders, obligation reimbursement ought to be your first concern. Then again, in the event that you don’t have exceptional obligations to pay, maybe you need to chip away at developing your bank account. Different objectives to consider is setting aside up cash to work on the house, purchase a home or vehicle, begin an independent venture, and so on. The kind of monetary arrangement you want will rely upon what you need to accomplish.

Be prepared to surrender a few things. With an end goal to chop down your costs, you ought to be ready to surrender a few things that you might need, however not actually need. Self-restraint is dependably important to make a financial plan arrangement work. For example, on the off chance that you have been accustomed to going out to a movie theater or celebrating with your companions consistently, maybe you might consider doing it just a single time or two times every month to set aside cash. Little forfeits will go far and you simply need to perceive the more significant things from the not so significant ones.

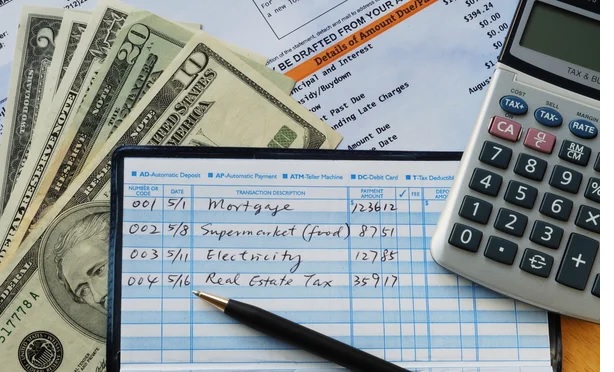

Screen your spending for the following 2 months. Making a reasonable spending arrangement is a test in itself in light of the fact that monetary circumstances and capacities fluctuate starting with one individual then onto the next. You could have to notice your own ways of managing money for the following little while. Make certain to record every one of your costs, from huge buys down to the littlest pennies. Making a rundown of your consumptions is the most ideal way to see where your cash goes. You may be shocked to find later on that numerous things on your rundown are not exactly that significant in your life, however gobbling up a huge piece of your profit. In view of your rundown, you will actually want to make a few changes and changes where required.

Work together with your relatives. Assuming you are living with your family, it’s vital to examine your planning plan with everybody, particularly with your kids, so everybody can do his/her own portion to make the arrangement a triumph. Talking cash matters with the family is sound on the grounds that the kids will actually want to see the significance of following a financial arrangement and the why setting aside cash is significant.

Kill additional charges from your bills. In the event that you can keep away from the loan cost charges from your Visas as well as late punishment expenses on the entirety of your bills, you will actually want to save a lot of cash in a year. You can kill pointless expenses by covering your month to month charge card balance and paying every one of your loan bosses at the very latest your due date. This could seem like a conspicuous procedure however numerous buyers are inclined to paying late expenses and loan costs which is a finished misuse of cash.